Cellular Put Pub Harbor Financial & Faith

Blogs

That is good for professionals which don’t should input the credit details, which have many other security features and you may protections to have people gaming via PayPal places. The cash are simply placed into their portable costs and you will gathered by your cellular telephone driver regarding the usual method, instead of via a payment strategy related to you. This makes it a far more secure treatment for put to the your account, with no chance on the painful and sensitive commission facts in the process. The funds out of a mobile look at put are usually provided in a single to a couple of working days. For legal reasons, at least $225 of one’s money will likely be readily available by second organization go out, on the sleep available next business day.

Chase Cellular Look at Direct Deposit Day – Business days – leading site

To finish their verification also to process people detachment, we need one to upload one of several documents in the list below. This helps us confirm we are make payment on best individual and you will covers our players against people authorised use of its account. Book away from Lifeless by Gamble’n Go the most popular ancient Egyptian-styled game available. James did inside the low-league football while the a click officer before duplicate-editing local and you may federal push from all around Great britain. You can also find on line brands away from classic casino table online game, such black-jack, roulette, and much more. If harbors are the thing that you’re once, you will find all kinds to help you appeal to a variety of pro choices.

Easy accessibility

Placing a check at the an atm normally comes to inserting their debit credit, typing the PIN and you may pursuing the to your-display recommendations. The newest Automatic teller machine will normally cause you to submit the newest check up on a specified slot — just be sure to double check you’ve selected the correct deposit account ahead of submitting. You could hold the transaction acknowledgment before the put clears in case of one things. For individuals who’lso are going to put a large amount of cash to your a lender membership, make sure that they’s secure. It means the cash on your accounts — examining, discounts, currency market, etcetera. — try immediately safe as much as a quantity (always $250,000 or even more) against financial incapacity.

Will there be a limit to the amount of cheques I’m able to spend within the?

Available in your own Byline Lender cellular app, Zelle are a quick and simple way to flow currency anywhere between you and individuals you realize–irrespective of where it bank. The conventional means to fix put a is to visit your regional financial branch. Once endorsing your look at, you might fill out a deposit sneak, include the look at and hands they so you can a teller. This method was specifically beneficial if you’d like one guidance or have questions relating to the process, as the tellers or any other banking pros will be available to help you let. Today, your routinely have several options for placing a check. Let’s consider particular usual a method to put a check and you will exactly how each one of these usually functions.

- Government laws wanted a financial otherwise borrowing union’s cutoff returning to choosing dumps getting zero prior to when 2 p.meters.

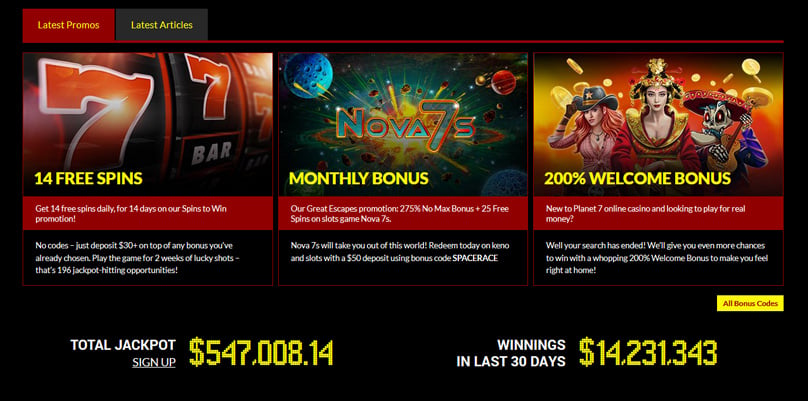

- Cashback are a pleasant method to decrease your exposure of shedding real cash.

- There isn’t any restrict to help you put numbers but not depending on the amount there might be a hold on tight the newest put from it isn’t done in to the an excellent Wells Fargo department strengthening.

- Using an upgraded adaptation will help include their account and supply a much better experience.

- Debt organization then converts you to visualize for the a substitute look at, that will legitimately alter the new report look at.

- Reviewing your finances equilibrium is also important so you can position any instances of scam.

- All transactions that you build can be put in your own smartphone expenses, otherwise deducted instantly from your offered cellular phone borrowing from the bank.

Immediately after gotten, FinCEN have a tendency to investigate the game to determine if your membership is actually working in any fraud, currency laundering or radical financing. For banking companies, it’s felt simple process and you can isn’t a cause to own concern in case your deposit is actually genuine. Cellular transferring relates to mailing or discarding the first currency acquisition, which can be missing otherwise stolen inside the transit. This can lead to a potential loss of financing or name thieves should your view drops for the incorrect hand. The first step should be to recommend the bucks acquisition from the signing they on the rear.

The value of one spin is actually £0.ten, plus the render can be acquired to possess 1 week. Along with, you are going to get the 50 revolves once you put, however you have to email address the help party for the rest of her or him. Throughout the our evaluation, we learned that Immortal Wins try a high local casino you to definitely welcomes Charge, Charge card, Spend from the Cellular phone and you will Maestro deals. You could potentially put as low as £5 through cell phone transactions, you could’t withdraw their profits that way. But not, cards money have in initial deposit and you may withdrawal minimum limitation away from £ten there’s zero monthly detachment cap.

Book of Inactive and you will Starburst extra spins have to be wagered 50 moments within 7 days. For each and every set of bonus money comes with a great 50x wagering specifications and ends 30 days just after activation. The utmost cashout for the revolves are £20, because the cashout limit to leading site the extra cash is 3 times the advantage acquired. Among the 10 available banking procedures at the Virgin Games, professionals can use PaybyPhone, Neteller, Skrill, Visa, Bank card, and you can Lender Transmits. All of the actions has a withdrawal lifetime of dos-3 days and need at least deposit away from £10.

To your a tuesday afternoon, all you have to would be to go back home and enjoy your own sunday. But if it’s pay day plus workplace doesn’t provide head deposit, you’ll need to make a visit to the lending company. Verification out of a cellular put isn’t a guarantee it claimed’t be came back. If the cheque bounces as the individual that published they doesn’t have enough money in their membership to cover they, their cellular deposit was reversed. The brand new Cheque Clearing for the 21st Century Act allows banks to help you deal with replace cellular put cheques if they’lso are the newest courtroom equivalent of an actual cheque.

The new drawbacks of the program are lowest put constraints and no distributions ability. Unmarried dumps that have Boku try restricted to £10 when you are its each day limit try £31, so it’s a far greater banking choice for casual players. Along with, you will have to withdraw any payouts through an alternative fee approach.

Plus the progressive jackpots, the newest online game have several totally free revolves cycles, to make to possess exciting gameplay. Has functions experience in such big brands since the MatchingVisions, iBusmedia, Oddschecker. Get more suggestions about ideas on how to cover the mobile device away from fraud. Purposefully transferring an identical cheque more often than once is considered scam. Scam try a critical unlawful offense that’s punishable because of the a jail phrase.

1 Funds from payroll-relevant lead places could be offered as much as two days early. Early usage of payroll deposits pertains to the newest head put out of money from your employer. Employer lead dumps are different and you can, as a result, this is simply not you’ll be able to to ensure early usage of your income. Items that can connect with which include the sender’s deposit breakdown used and the timing of the distribution away from put.

For those who’lso are wanting to know whether that one can be obtained during your lender, the brand new brief response is probably yes. In case your financial have a mobile software, it probably also provides cellular deposits. If the cellular cheque put is not operating and you believe you’ve complete that which you precisely, there might be a problem with their cellular financial app. In that case, you might get in touch with your lender or borrowing from the bank union to help you ask if your app are off and you will, in that case, when mobile cheque deposit may be recovered. You could ask about most other deposit alternatives meanwhile if you would like add the cheque for your requirements As soon as possible.

How long before you can access your deposited Wells Fargo finance utilizes the kind of deposit and you may whether or not Wells Fargo towns a hang on the bucks. GOBankingRates’ editorial party is purchased bringing you objective analysis and you can guidance. We have fun with study-motivated methodologies to test lending products and you can characteristics – the reviews and you can analysis aren’t dependent on entrepreneurs. You can read more info on our very own editorial advice and you can the points and you will characteristics remark strategy. He or she is a keen specialist and you will devotes his time for you coating everything you costs.

See cellular take a look at deposit for action with this interactive example. Rebecca Lake is actually an authorized teacher inside personal money (CEPF) and a financial pro. She actually is been discussing private finance as the 2014, along with her work have appeared in numerous books on line.